It became just slightly easier for aspiring first home buyers to get into a home of their own in May, as the benefits of falling house prices at the bottom of the market marginally outweighed the effects of rising interest rates.

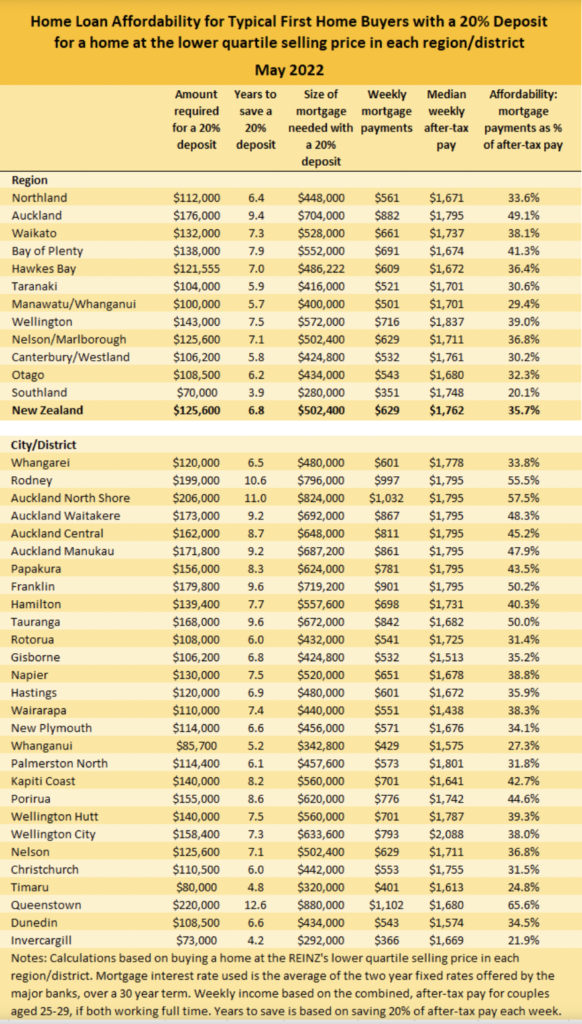

According to Interest.co.nz’s Home Loan Affordability Report for May, the Real Estate Institute of New Zealand’s national lower quartile selling price declined to $628,000 in May from $640,000 in April.

That reduced the amount needed for a 20% deposit on a lower quartile-priced home slightly, to $125,600 from $128,000.

It also reduced the amount that would need to be borrowed for an 80% mortgage by almost $10,000, to $502,400 from $512,000.

Unfortunately, most of the savings in mortgage payments that would have been derived from a smaller mortgage were eaten up by higher interest rates.

The average of the two-year fixed mortgage rates charged by the major banks increased to 5.10% in May from 4.96% in April (assuming a minimum 20% deposit).

The net effect of that was the mortgage payments on a lower quartile-priced home purchased with a 20% deposit declined to $629 in May from $631 in April.

In practical terms, the fall in house prices in May made it slightly easier for first home buyers to raise a deposit, while the effects of falling house prices on their mortgage payments were almost entirely offset by higher interest rates.

So first home buyers came out slightly ahead, but not by much.

Looking back over the last six months, the effects of changing market conditions on first-home buyers have been more mixed.

The REINZ’s national lower quartile house price peaked at $670,000 in November last year and has since declined by $42,000 to $628,000 in May.

That reduced the amount needed for a 20% deposit by $8400, although getting together $125,600 for a 20% deposit will still likely be beyond the reach of many.

The amount needed for an 80% mortgage declined by $33,600 between November and May, from $536,000 to $502,400.

Over the same period, the average of the two-year fixed mortgage rates increased from 4.08% to 5.10%, which pushed mortgage payments up from $596 a week to $629.

So the trend emerging for first home buyers is that house prices at the bottom end of the market are declining, reducing the amount they need for a deposit and the amount they need to borrow, while rising interest rates are pushing up their likely mortgage payments.

With interest rates continuing to rise at a substantial clip, the trend noted above is likely to continue into the short to medium term, unless house prices start falling at a much greater pace than they are currently.

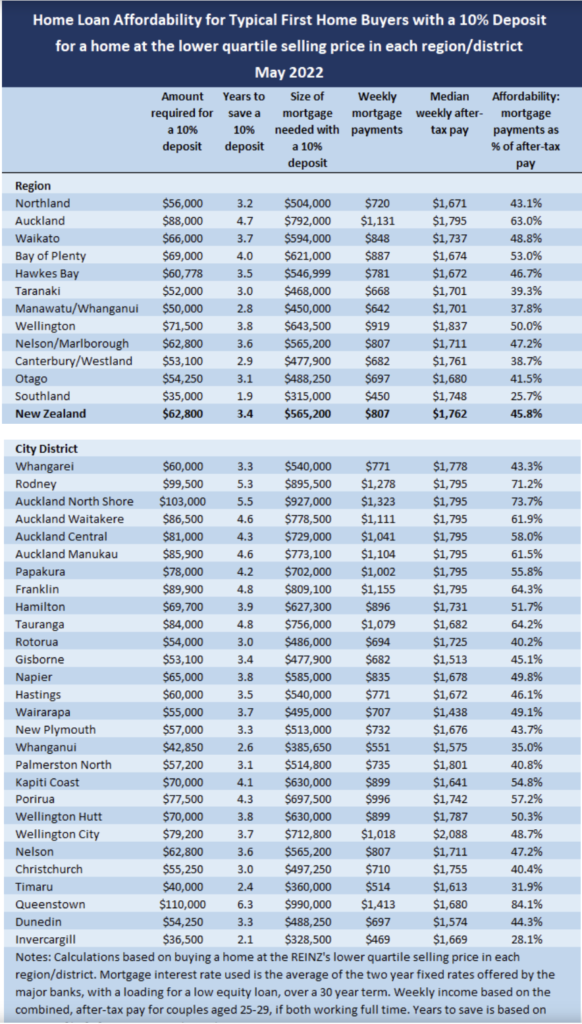

The tables below show the main measures of affordability for typical first home buyers in all of New Zealand’s main urban districts, with either a 10% or 20% deposit.