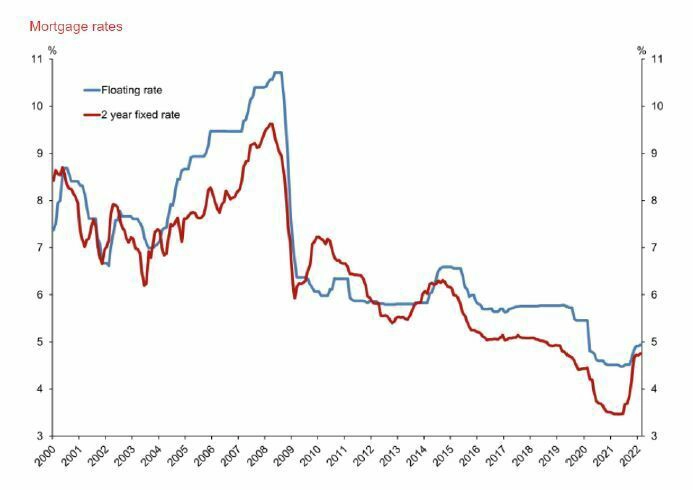

While the media focuses on “hikes” to the OCR which only affect floating interest rates and short term fixed rates like 6 months and 1 year, the longer-term fixed rates of 2, 3 & 5 years have steadily risen over the past 6 months.

This is primarily because the longer-term rates are funded through the bond market and offshore money markets in the USA and Europe.

We were also quick to forget the 1% “cut” the RBNZ applied to the OCR when Covid hit NZ. So for the past couple of years we have been living in a “falsely priced” interest rate environment which we convinced ourselves had become “the norm”. Now as OCR increases return, this is just putting back what was falsely removed.

The next OCR review is on the 13th of April and everything we are currently seeing is suggesting further OCR increases over the next 18 – 24 months in the 1.50% to 2% range. However, these increases still see us sitting at historically low-interest rates. Just to put this into perspective, take a look at how the rates have averaged around 7% post GFC 2008.

| The takeaway here is if you are coming off a fixed term now or in the near future, the expert help of a Mortgage Adviser can help you to structure your borrowings and save time and money in the long run. |