With the new regulations now in full effect, we are definitely needing to find every dollar possible for our clients in this changing market.

Most of the major banks have increased their “ test” rates lately which is the rate they calculate a client’s ability to afford a mortgage. Even though the interest rates are currently around the 4% mark, the banks will actually calculate affordability of a loan based on a “test” rate of around 6.60%.

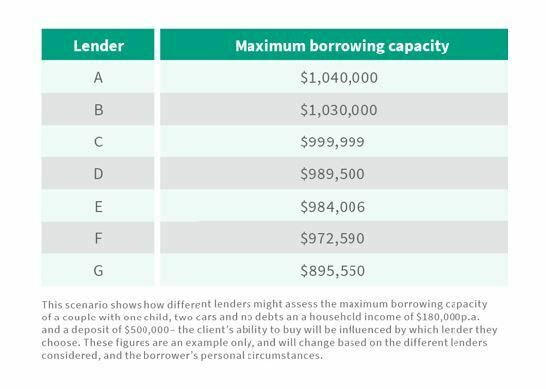

Some banks also use different methods when calculating your maximum borrowing power and you can see from the graphic below a quick comparison between Lenders and the maximum borrowing capacity available to the same couple with one child, no debts and a household income of $180k.

You can see that if you are dealing with Lender G who you may have banked with all your life, you are cutting yourself short by $144,450 and potentially missing out on getting that dream home.

By dealing with a mortgage advisor instead of a bank, you will have all options available to you.

If you would like some advice about your particular situation, please do not hesitate to get in touch with me for some recommendations.